We’ve all heard the saying “money doesn’t buy happiness” while that may be true, however one thing is certain: not having enough money surely makes life significantly tough”. While money may not directly bring happiness, but what it can do is, make your mind free to think and focus on other meaningful aspects of life, like health, relationships, and creativity.

But this raises an obvious question: How much money do we really need?

Is it a few thousand, a few lakhs, or even crores?

Believe it or not, we often need much less than we imagine.

So, how do we determine this ‘magic number’?

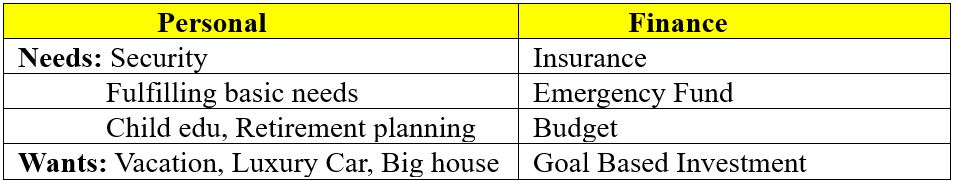

The answer lies in understanding two fundamental aspects of personal finance: needs and wants. It’s about recognizing your responsibilities toward your family, setting clear goals, and achieving a sense of fulfillment in life.

And that is precisely why it’s called Personal Finance.

Setting up a solid personal finance plan is an iterative process. It is not a onetime thing. It’s a long journey, journey towards achieving financial freedom.

This journey is only 20% about the numbers and 80% about planning and discipline.

As author Darren Hardy mentions in his book ‘The compound effect’, we’re a “rational” species, at least that’s what we call ourselves, but our need for instant gratification can turn us into impulsive beings.

But when it comes to discipline, we become most irrational species.

But why exactly do we need planning and discipline to achieve financial freedom?

There is a story about a man riding a horse, sprinting quickly. It appears that he’s going somewhere very important. Another man standing along the roadside shouts. “Where are you going?” The rider replies, “I don’t know. Ask the horse!”

This is the story of most people’s lives. They are riding the horse of their habits, with no idea where they’re headed. Its time to take control of the reins and move your life in the direction of where you really want to go. (Credit- Darren Hardy- The Compound effect)

That can only happen with a solid plan and discipline.

“If you fail to plan, you are planning to fail.“

This series isn’t about making more money or getting rich quickly. Instead, it’s about learning how to manage your money, making smart financial decisions, and working towards financial independence. Let your money work for you while you focus on unlocking the creative power of your mind.

By the end of this series, you will be equipped with valuable insights into personal finance planning, including budgeting, goal-based investing, and determining how much money you need to retire early.

So, are you ready?

Let’s get started!