Whether you like it or not, taking medicine is the best and quickest way to recover from poor health. Similarly, whether enjoying it or not, regular exercise is the best way to keep yourself healthy for a longer time. The precisely similar analogy applies to the personal finance, you like it or not, managing your finances is the only possible way to achieve your financial goals and get financial freedom within an optimal timeframe.

Eventually, you are the one who would be responsible for your financial success or failure.

This article is specially written for all the people who believe financial planning requires financial expertise. B

believe me, this post will change your perspective .

This article is specially recommended for those:

- who think their income is too low to do financial planning.

- who think they are too young or old to do financial planning.

- who are financially dependent on someone else.

- who know about financial planning but don’t know how to start.

- who are curious to know, “What the hell is this financial planning?”

I have tried my best to write this article in a fashion as simple and as practical as possible, so everyone could understand easily.

Having an awareness of your own finances and financial goals is one of the most expensive gifts you could give to yourself and your family.

Let’s go through a story first

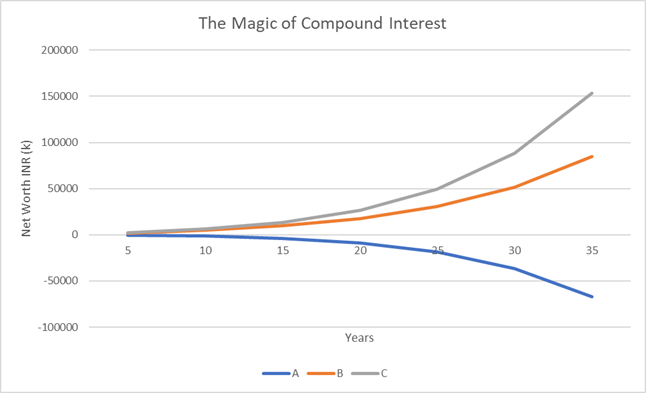

There were three friends A, B and C with exact similarity in their annual income, work, education, family background and skills. The only one difference was in their income handling practice. It was as below

Person A: Spendthrift or we can say big spender, who first spend all the money he earns, by the end of the month. So, for him Expenses = Income.

Person B: Miser or money saver, who save first and then spend. So, for him Expense = Income- Saving.

Person C: Investor, who invest some part of money first and then spend remaining part. So, for him Expenses = Income – Investments.

Let’s see how their habit reflects in their wealth over the years.

Now… what is happening here??

Person A goes under the heavy debt over the years.

Person B manages to beat inflation.

Person C gets around 80% more wealth than B after 35 years with same spending habits.

The wealth gap is a direct result of continuous disciplined investment in proper assets. This is the effect of well-planned personal finance. The rest will be taken care by compound interest.

The concept of compound interest is very simple. The longer you stay invested, the exponential interest will be.

Financial planning is a bridge between your current income and your financial goals; if you don’t have this, you won’t get it there unless you win the lottery. It is as simple as that.

What is Financial Goal?

Financial goals are the milestones or targets one wants to achieve over a set period of time. It is often driven by our needs and wants.

Let’s see some examples of financial goals: Owning a house, owning a car, marriage, children’s education, holiday trip with family, retirement corpus creation, opening a new business, emergency fund, early retirement, wealth creation.

But what’s wrong with these goals? They all are vague, with no timeline, no plans, so it just becomes a wish of someone that “I’ll have my own house or car one day.” So, setting up a SMART financial goal is the essential thing before doing financial planning.

S: Specific M: Measurable A: Achievable R: Relevant T: Time-bound

How to set a SMART financial goal?

It’s simple, just like one sets a goal for losing or gaining weight in the gym.

Here check with the below example.

My weight is 75 kg, and I want to reduce it to 70 kilograms in two months. I have upgraded my diet plans accordingly, along with my daily 1-hour exercise. But Since I have pain in my shoulder, I could not lift heavy weights, so I must focus more on other alternate activities that do not involve lifting heavyweights ( knowing your risk zone).

That’s exactly how your financial goal should be. You should know precisely what you want to achieve, how much time you want to accomplish that, your current financial situation, your pain points, and accordingly, you have to start planning for your financial goals.

Write down your financial goal, keep a note, track your progress, and upgrade strategies to stay in sync.

How to do personal financial planning?

Financial planning is the step-by-step approach of managing your investments, savings, and expenses to achieve your financial goals. It contains planning, execution, and regular monitoring.

Conventional wisdom says spend first and save the remaining

Income – Expense = Saving

Modern Financial literacy says invest first and then spend the remaining.

Income – Investment = Expense

But, where to invest? How much to invest? How to start? Is there too much risk? These questions keep many people away from taking their first step in investing.

Too many investment options make it more complex to decide where to start; also, lack of adequately organized information makes many of us wait and wait and wait to begin our first move. Remember, time is one of the key players in investing. The earlier you start, the more you grow.

It’s been observed over the years that, generally people channelize their monthly income in the below sequence.

Income –> Spend –> Save –> Invest–> Insure

So, they spend first, then save the remaining, and by chance, if left with some, they invest and very rarely people take insurance. (Only 3.3% Indian population is covered under life insurance. Source: edelweisstokio.in)

This flow of practice would put you under the debt ground soon or with no much money left over the years to achieve your long term financial goals.

Financial literacy suggest the correct sequence of income flow should be the exact opposite of the former one. This would help you in your assets growth and to achieve your financial goals within the planed timeline.

To get a rise in the momentum of your wealth. First, channelize your income in the following sequence.

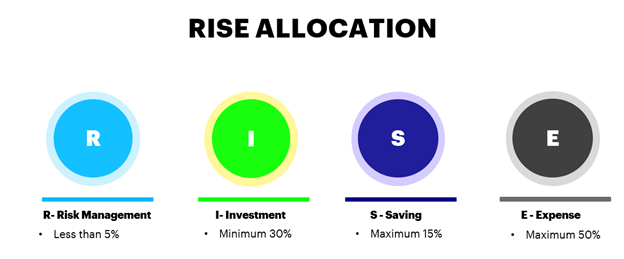

I put the flow order in simpler way to understand…I call it as R.I.S.E. model

R: Risk Management

I: Investment

S: Saving

E: Expenses

Income –> Insure –> Invest –>Save–>Spend

That is Income –> Risk Management –> Investment –>Saving –>Expense

1. Risk Management

Risk Management is important pillars of financial planning. And it always should be on the top of every financial decision. Without risk management, your financial goal can collapse at any moment in life.

Risk management is like wearing a helmet before driving, wearing a safety kit by batsman before batting. But often it seems most avoided while making financial planning since, only 3.3% Indian population is covered under life insurance. (Source: edelweisstokio.in Dec 2020, personal finance management India)

No matter how much money you make or save or invest without risk management, you are putting yourself and your dependent near and dear one under financial risk.

In simple words, risk management aims to insure yourself properly.

Remember financial goals of your dependent are also depend on your financial planning.

For details of insurance kindly visit authorized insurance website or take consultation from financial advisor. Below is simple overview of basic insurance types and when and how much amount to allocate under risk management.

Basic Types Insurance:

Health Insurance: Basically it is for health emergencies. under this insurance, hospital expenses till opted amount will get covered by insurance company.

Life Insurance: Life insurance classified into two plans

1st: Endowment insurance : Lump sum amount will be paid to the policy holder at the end of the maturity period .

- Comparative high Premium than term insurance

- Moderate cover amount

- Money back policy on the end of maturity period

2nd:Term Insurance: Policy holder have to pay premium upto the specific term and in case of unfortunate event dependent will get the covered amount.

- Comparatively less premium than Endowment insurance

- High cover amount

- No premium back policy on the end of term

Product insurance: This insurance is typically for valuable and tangible assets like car, bike, phone, home insurance etc.

When should one opt for an insurance?

Life is uncertain so opt for insurance as earlier as possible. In case of term insurance the earlier you opt the less premium you have to pay throughout the term.

Recommended Best time to get insurance: Right after reading this article.

How much one should invest?

Health insurance premium will be decided based on your age and current medical conditions.

Term insurance will be based on HLV (Human Life Value). It represents ,the amount of cover you can claim based on your annual income. It is generally 20 to 25 times of your annual income.

Before applying for insurance make sure it would cover financial goals of your dependence in absence of you. It should also cover your loan if any, and your family’s future expenses

Never consider your insurance as a investment, So one should pay maximum up to 5% of annual income in Risk Management Section. Again there is no such rule.

2 Investment

According to Robert Kiyosaki the Author of best seller personal finance book ‘Rich Dad Poor Dad’ . Investment is the science of money making money.

If financial planning is the movie, the Investment must be the lead character.

Investment is the strategic channelization of your income to get better returns than inflation in the coming future. Returns from Investment are called passive income. These returns are in terms of interest on saving , profit over stocks, dividend on stocks, rental income from owned property, royalty, etc.

To invest the money in proportion to different financial instruments or assets in order to get better returns considering risk factors is called as asset allocation.

Asset allocation strategies are defined based on three major factors are Risk, Time, and Returns corresponds to each asset.

Below is the list of general assets classes where one can Invest

1. Equity

- Stocks/Share

- ETF

2. Mutual Fund

- Equity MF

- Debt MF

- Hybrid MF

- Liquid MF

- Other

3. Real Estate

- House/apartment -rental property

- Plot

- Farmland

- Shop – rental

4. Gold

- Physical gold

- Digital/Paper gold

5. Government Schemes and Bonds

- Public Provident Fund (PPF)

- National Pension Scheme (NPS)

- Sukanya Samriddhi Yojna (SSY)

- Employee Provident Fund (EPF)

- Voluntary Provident Fund (VPF)

- Many more

6. Own Business

7. Crypto-currencies

3 Saving

Often people confuse savings with Investment. Saving money is nothing but storing them in a box that never grows. But saving is helpful in case of emergency. So it is called an emergency or contingency fund.

In emergency cases like sudden hospitalization or job loss or a house repair, etc., its always better to keep some corpus in hand where we can have quick access to this fund.

Taking funds out of your investment soon is never advisable since, it breaks the compounding effect chain, and also, often some investments take time to credit to you quickly. Like real estate and gold.

How much should the saving be? Thumb rule is, it should feed you and your family for a minimum of six months. So, six times your monthly expenses or income should be your Savings.

4 Expenses

The best way to reduce expenses is to be aware of those. Note down, budget and review.

It’s always advisable to budget your expenses on weekly or monthly basis. Categorize it, so can have clear idea of your spending areas . Know your needs and wants very well. Prioritize your needs first and then wants and make your expenses and investment align to possible long-term expenses.

It’s always good to have wants that will keep you encourage to earn more and enjoy life.

According to Thomas J Stanley, the author of the book ‘The Millionaire Next Door’ if you are not wealthy but want to be someday, never purchase a home that requires a mortgage that is more than twice your annual income.

Risk Management and Saving is a kind of one-time activity, so the dynamic pillars are the investment and expenses. Lower the percentage allocation in expenses higher the allocation you could do in Investment, subsequently more your assets will grow.

Taxes and loan are major expenses also. One can optimize these expenses by knowing various tax saving options.

Some basic options are mentioned below.

Section 80C – Deductions on Investments

Section 80D – Medical Insurance

Section 80EE – Interest on Home Loan

Section 80GG – House Rent Paid

Section 80E – Interest on Education Loan

For example purpose, the allocation for the RISE model is could be as shown in the below image. Remember these percentages are not as per any standard rules but based on a particular assumption.

Basic target is to align your R. I. S. E. allocation in order to achieve your SMART financial goals.

Keep these points in mind

- Do not invest where you don’t understand

- Do not consider your insurance as your Investment

- Develop a habit of self-discipline and patience

- Consider future lifestyle Inflation while making financial decision

- Always pay yourself first

- Expenses = income – Investment

- Know the difference between Needs and wants

- Review your Investment Strategies regularly

- Make sure you have maintained nominees for all your investments and bank account

- Do not get into a big loan unless its very necessary

- Understand mystery of credit card

- Diversify your investment (do not put all your eggs in one basket)

- Do not over diversify

- Do not fall for a quick shortcut way to be wealthy

- Know your risk-taking capacity

- Keep your emotions in control while making financial decisions

- Financial freedom formula: Cash flow from assets >= expenses

- Most valuable asset is time: so start as early as possible

- Understand the Cost of delay in investment

- Last but not least, do not compromise on your dreams, instead start planning for it now

Disclaimer

Personal financial planning is entirely based on your financial goals, so it need not to be same for every individual. So, choose your RISE model wisely, which may not be best for others. So, for more details consult your financial advisor before investing. Author is not SEBI registered consultant or financial consultant. Understand your requirement and then invest in any financial tool. The purpose of this article is only to give you a general sense of financial planning. This article is purely a view of the author. Kindly study and take advice before investing your hard-earned money in any asset class. Do not blindly follow others. Know your priorities and risk-taking capacities. All assets instruments are subject to market risk. Always read terms and condition documents carefully before investing.

References

- Book: Rich Dad Poor Dad by Robert Kiyosaki

- Book: The Richest Man in The Babylon by George S Clason

- Book: Millionaire Next Door by Thomas J Stanley

- franklintempletonindia.com

- policybazaar.com

- cleartax.in

- primeinvestor.in

- statista.com

- mahitilake.com

- tradingeconomics.com

- edelweisstokio.in

Annexure

| Person | Monthly income | Saving | Investment | Expense | Annual Growth | Inflation rate | ROI | Net ROI |

| A | 50000 | 0 | 0 | 50000 | 10 | 5.52 | 0 | -5.52 |

| B | 50000 | 25000 | 0 | 25000 | 10 | 5.52 | 6 | 0.48 |

| C | 50000 | 0 | 25000 | 25000 | 10 | 5.52 | 11.3 | 5.78 |

**All the values are in INR

| Person | in 5 yrs | in 10 yrs | in 15 yrs | in 20 yrs | in 25 yrs | in 30 yrs | in 35 yrs |

| A | -253402 | -1304082 | -3836829 | -9015535 | -18794510 | -36425646 | -67282794.07 |

| B | 1852320 | 4880384 | 9803083 | 17778226 | 30670501 | 51483034 | 85052418.65 |

| C | 2097668 | 6156458 | 13594399 | 26766847 | 49561968 | 88367291 | 153636343.78 |

Assumptions:

· Annual income and expense growth rate is 10%

· Savings interest rates are based on average current bank FD rates

· Investment interest rates are based on average annual returns (CAGR) of NIFTY since last 20 years

· Indian inflation rate March 2021 is considered from trading economics website

“Do you agree with the R.I.S.E model? “What do you think about personal financial planning ?” Share your thoughts in the comments below!

You can also convey your suggestions or comments at our official mail id admin@infofable.com

Agreed, This is a need of current generation and one must have it.

This Article provides the idea how we can structure our finance.

Thanks for sharing it.

Thanks for your reply Anup!

Yes absolutely, basic idea of personal finance is always needful for everyone.

Glad to have your view.

Got clear thought …how to plan for future..

Agreed sumit in this way we can make our financial planning and very important in respect to our future…

Thanks for your response Sir!

Great to have your valuable feedback.

Great!! Glad to know that.

Thanks for your response Vaibhav!

Very well said brother in simplest manner.

Really helpful to plan for future as well for present and past debt clearance.

Eye-opening experience by reading can’t explain practical out comes through planning in said ways.

Thanks !

Thanks for your response Ajay!

Great to know that! It my pleasure to have your thought on this article.

Dear Sumitji,

It’s nice & smart model to grow rich & rise in life while fighting against inflation & expenses. The percentage of RISE may differ based on future goals & age.

Thanks.

Explained in concise way and lucid language.

helpful for newbies to get start with. Personally liked RISE practice.

Thanks for your response!

Happy to know you like RISE model practice.